SBA Loans: Fueling Your Business Growth

Unlock the potential of your business with our fast, hassle-free SBA loan process. Enjoy reduced wait times and seamless approvals, giving you the capital you need to scale faster and boost productivity. Take the next step toward success today—secure the funding to drive your business forward.

SBA Loan Benefits for Small Businesses

Looking for a flexible, affordable, and efficient way to fund your business? SBA loans are your go-to solution. Discover the numerous advantages SBA loans offer, designed to empower your small business with the capital it needs to thrive.

Flexible SBA Loan Options

Need to buy equipment, acquire property, or cover other business expenses? SBA loans are one of the most flexible options out there.

Quick Access to Capital

With the federal government guaranteeing 75% to 90% of the loan, banks are more willing to lend—even if you have limited collateral.

Favorable Terms

SBA loans offer longer repayment periods and lower interest rates, making them a better choice compared to many other loan options.

SBA Loan Offerings

We provide a wide variety of SBA loan options, making it easy for businesses of all sizes to find the perfect financing solution.

Business Acquisitions

Use SBA loans to buy an existing business with as little as 5% down. Whether or not real estate is involved, our online SBA loans make the process smoother and more affordable.

Start a Business

Starting a business can feel overwhelming, but our specialized SBA loans have helped countless entrepreneurs turn their dreams into reality.

Buy Commercial Real Estate

Finance up to 110% of owner-occupied commercial real estate with our customized SBA loans. Enjoy the perks of owning your property while keeping your cash flow healthy.

Ready to Get Started?

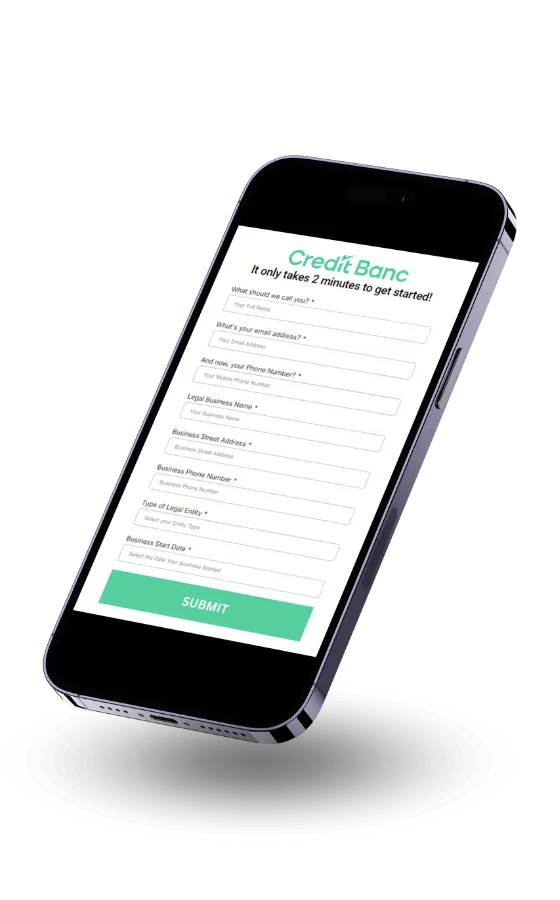

Essential Documents for Your

SBA Loan Application

How you plan to use the funds

3 years of business and personal tax returns

Profit and loss statement

Balance Sheet

Personal Financial Statement

Business Debt Schedule

Bank statements (6 months)

Our expert team will guide you through the SBA loan application process, helping with all the necessary paperwork at every step. We make applying for small business loans online simple and stress-free.

What Sets Us Apart

Our expert team guides you through small business financing to ensure you make the right decision.

We create customized financing solutions tailored to your unique business needs and goals.

With a wide range of options, from SBA loans to lines of credit, we have the right solution for you.

Get fast, reliable funding so you can focus on growing your business.

It Only Take 2 Minutes to Get Started!

Check to see if you pre-qualify...no impact to your credit score!

Check to see if you pre-qualify...no impact to your credit score!

FOLLOW US

COMPANY

PROGRAMS

RESOURCES

Copyright 2026. Credit Banc. All Rights Reserved.

Need to contact us? Please email the team at

.